Supply & Demand + Order Flow

Are you ready to revolutionize your trading game? Imagine having a powerful tool at your disposal that gives you a significant edge in the markets. Look no further than Orderflows Algo - the ultimate solution for effortless trading success.

Orderflows Algo uses cutting-edge order flow analysis as well as traditional analysis to pinpoint key areas of supply and demand in any market. This allows traders to more accurately time their entries and exits, capturing big moves as institutional money flows in and out.

Hi, my name is Michael Valtos and since 1994 I have been trading for banks (JP Morgan and Commerzbank) as well commodity trading houses (Cargill and EDF Man) and for myself. While trading for the investment banks I learned how to get information out of the market and how to trade off that information into a profitable position; when there is an opportunity to earn a significant return relative to risk you get into a position. While trading at commodity trading houses I learned to think how commercial end-users think; you are always in a position just by being in that business whether or not you chose to hedge a position in the futures market. Ultimately, I learned successful trading came down to two things: Order Flow and Supply & Demand.

One of the biggest struggles for traders is consistently and correctly identifying key areas of supply and demand in the market. Without being able to pinpoint where buyers and sellers have been entering or exiting, it's incredibly difficult to time trades properly. This causes many traders to mistime their entries and exits, leading to missed profit opportunities or unnecessary losses.

Making precise trading decisions is another hurdle for traders. Even when they manage to identify supply and demand zones, the inability to determine optimal entry and exit points within those areas leads to reduced profitability. A lack of precision means you either leave money on the table with exits that are too early or let winning trades turn into losers by holding on too long.

These deficiencies in identifying trading locations and executing with precision lead to broad challenges like inconsistent results, emotional and financial stress, and an inability to generate steady profits over time. Missed trades and improperly timed entries or exits can quickly decrease a trading account when repeated frequently.

The good news is that order flow analysis helps overcome these deficiencies. By using order flow together with supply & demand, traders can accurately locate areas of imbalance and high-probability trading zones. This takes the guesswork out of supply and demand analysis and provides precision entry and exit signals. Alleviating these trading struggles can unlock your trading potential and improve your trading results.

Making precise trading decisions is another hurdle for traders. Even when they manage to identify supply and demand zones, the inability to determine optimal entry and exit points within those areas leads to reduced profitability. A lack of precision means you either leave money on the table with exits that are too early or let winning trades turn into losers by holding on too long.

These deficiencies in identifying trading locations and executing with precision lead to broad challenges like inconsistent results, emotional and financial stress, and an inability to generate steady profits over time. Missed trades and improperly timed entries or exits can quickly decrease a trading account when repeated frequently.

The good news is that order flow analysis helps overcome these deficiencies. By using order flow together with supply & demand, traders can accurately locate areas of imbalance and high-probability trading zones. This takes the guesswork out of supply and demand analysis and provides precision entry and exit signals. Alleviating these trading struggles can unlock your trading potential and improve your trading results.

Introducing Orderflows Algo:

Your Solution to Supply and Demand Trading Woes

Your Solution to Supply and Demand Trading Woes

The Orderflows Algo is the solution you've been searching for. Let's delve into the key features and benefits of this powerful software, designed to pinpoint hidden supply and demand levels with unrivaled accuracy.

Precise Identification: Say goodbye to the frustration of searching for needles in haystacks. Orderflows Algo's powerful algorithm does the heavy lifting for you, accurately pinpointing crucial supply and demand levels. No more second-guessing or missed opportunities – just crystal-clear identification of the most significant zones.

Precise Identification: Say goodbye to the frustration of searching for needles in haystacks. Orderflows Algo's powerful algorithm does the heavy lifting for you, accurately pinpointing crucial supply and demand levels. No more second-guessing or missed opportunities – just crystal-clear identification of the most significant zones.

Timing Mastery: Timing is paramount in trading, and the Orderflows Algo provides real-time insights into supply and demand zones, empowering you to time your entries with confidence. Bid farewell to moments of hesitation or chasing after false breakouts. With cutting-edge timing indicators, you'll strike at the perfect moment for maximum profitability.

Streamlined Confirmation: Confirmation is key, and the Orderflows Algo simplifies the process with built-in confirmation tools that validate your analysis. No more cluttering your screen with multiple indicators – we've streamlined the process, making it simple yet effective.

Unveiling Hidden Opportunities: the Orderflows Algo excels at uncovering hidden supply and demand levels, giving you an edge in the market. Bid adieu to missed opportunities and welcome potential profits you never knew existed.

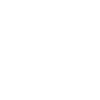

Consistent Results: Consistency is crucial, and the Orderflows Algo ensures that every trade is based on a proven strategy, eliminating guesswork and increasing your chances of success. Say farewell to rollercoaster rides and embrace a smooth path towards consistent profitability.

Personalized Experience: the Orderflows Algo offers extensive customization options, allowing you to tailor the indicator to match your unique trading style. Adjust parameters, timeframes, and visualization to make it your personal trading companion, aligning with your preferences and enhancing your overall trading experience.

Experience the transformative power of Orderflows Algo and revolutionize your approach to supply and demand trading. Say hello to accuracy, confidence, and profitability like never before!

The Methodology Behind Orderflows Algo:

Unveiling Real-Time Supply and Demand Imbalances

Unveiling Real-Time Supply and Demand Imbalances

Orderflows Algo operates on a sophisticated methodology that delves deep into the analysis of real-time supply and demand imbalances, providing traders with a competitive edge in understanding market behavior. Let's explore the cutting-edge algorithms and techniques utilized by Orderflows Algo to shed light on market dynamics and identify pivotal supply and demand zones.

Understanding Zone Formation: The positioning of a zone is crucial, and Orderflows Algo takes this into account. Whether a supply zone emerges after a move up or down, or a demand zone surfaces during a rally or after a downward move, these factors play a pivotal role. Consideration is given to what triggers the formation of a zone – a demand zone is formed with buying, signaling the entry of fresh buyers into the market after a downward move. Similarly, strong demand zones manifest after substantial selling, while strong supply zones materialize after significant buying activity.

Understanding Zone Formation: The positioning of a zone is crucial, and Orderflows Algo takes this into account. Whether a supply zone emerges after a move up or down, or a demand zone surfaces during a rally or after a downward move, these factors play a pivotal role. Consideration is given to what triggers the formation of a zone – a demand zone is formed with buying, signaling the entry of fresh buyers into the market after a downward move. Similarly, strong demand zones manifest after substantial selling, while strong supply zones materialize after significant buying activity.

Tailored to Trader Preferences: In the world of trading, each firm and trader has their unique approach, be it order flow analysis, price action, indicators, Fibonacci retracements, and more. However, the critical element is not the methods they use but rather the placement and execution of their orders within the supply and demand zones.

Orderflows Algo leverages advanced algorithms to identify these critical trading zones, providing traders with unparalleled insights into the ebb and flow of supply and demand dynamics. By recognizing these pivotal zones and the behaviors that shape them, traders gain a strategic advantage in their decision-making process.

The emphasis on real-time analysis of supply and demand imbalances sets Orderflows Algo apart, empowering traders to navigate the market with precision and confidence. It's not just about trading – it's about strategically positioning and executing orders within the supply and demand zones to capitalize on market movements and achieve trading success.

The emphasis on real-time analysis of supply and demand imbalances sets Orderflows Algo apart, empowering traders to navigate the market with precision and confidence. It's not just about trading – it's about strategically positioning and executing orders within the supply and demand zones to capitalize on market movements and achieve trading success.

Let's look at the unique features of Orderflows Algo, highlighting how each one enhances trading precision and decision-making:

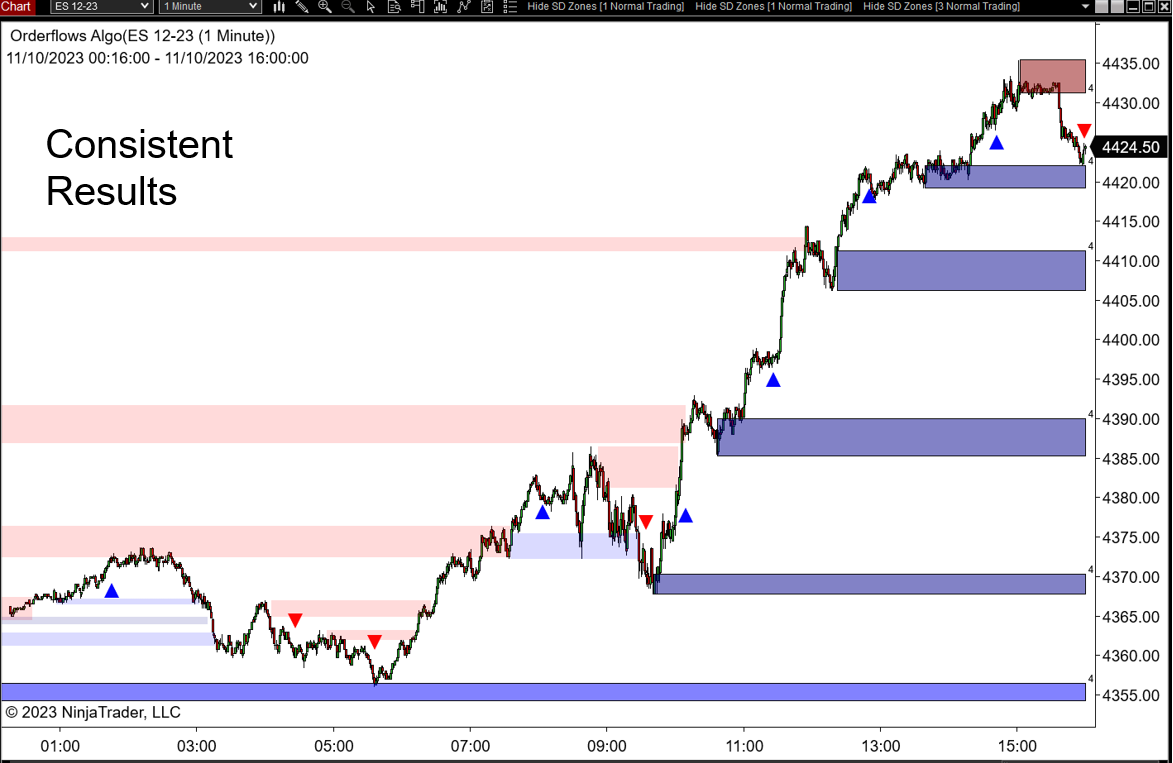

Customizable Parameters of Supply and Demand Strength: Orderflows Algo offers traders the ability to customize parameters related to supply and demand strength, allowing for tailored analysis and strategy development. By adjusting these parameters, traders can fine-tune the software to align with their specific trading style and preferences. This customization empowers traders to effectively analyze supply and demand dynamics, optimizing their decision-making process based on their unique market insights and objectives.

Advanced Orderflows Analysis: The software's advanced orderflows analysis provides deep insights into the flow of market orders, enabling traders to gauge market sentiment, identify buying and selling pressure, and anticipate potential reversals. By delving into orderflows data, traders gain a comprehensive understanding of market dynamics, empowering them to make informed trading decisions based on real-time orderflows analysis.

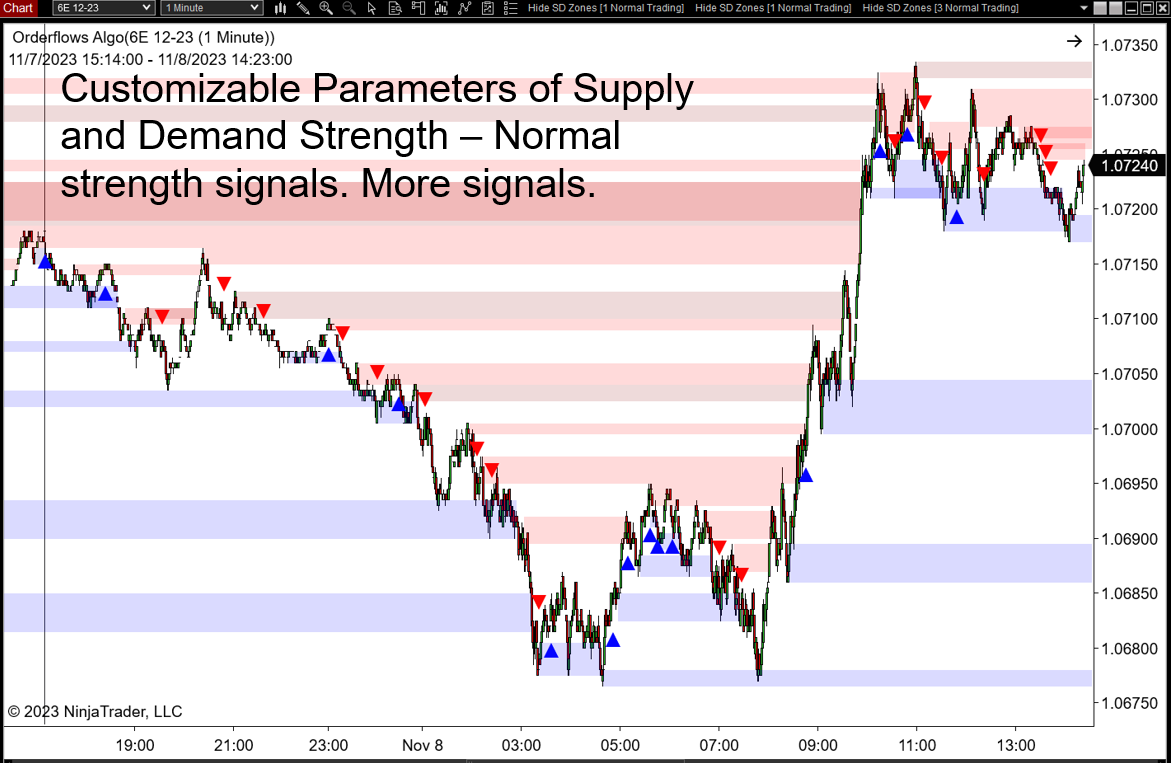

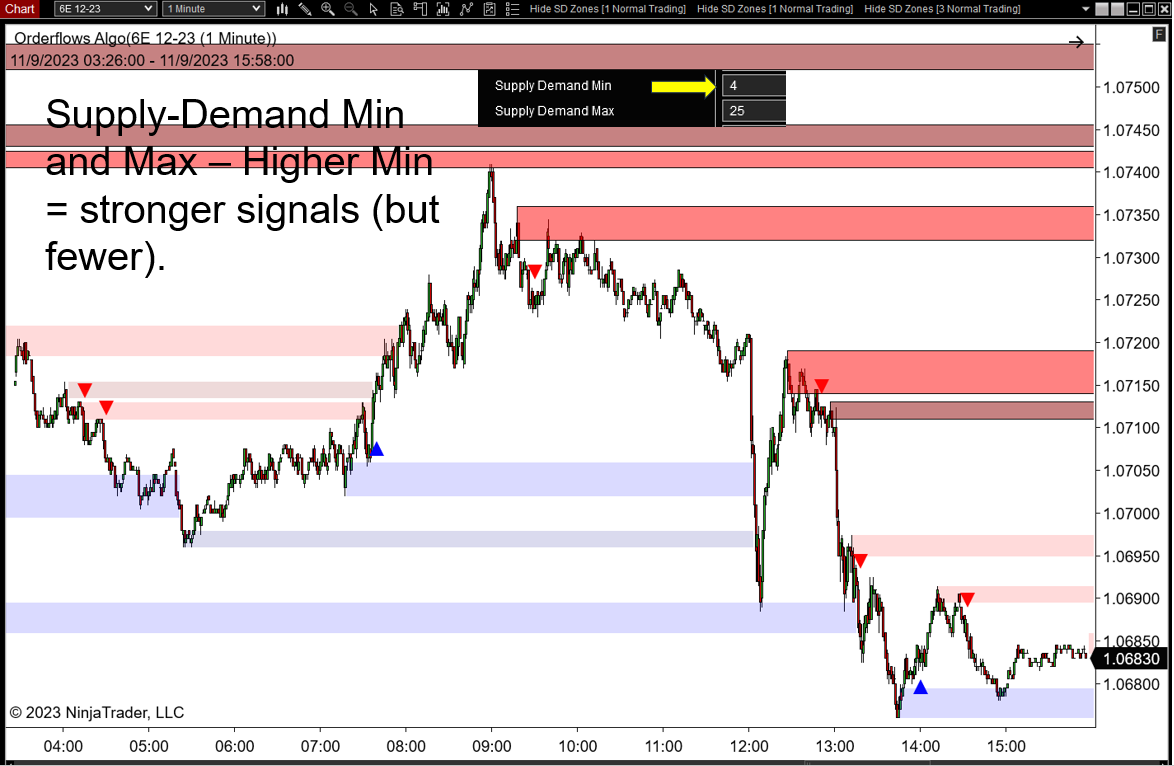

Supply-Demand Min and Max: Orderflows Algo incorporates supply-demand minimum and maximum levels, offering traders clear boundaries for identifying and evaluating supply and demand zones. These parameters create a framework for assessing the strength of supply and demand levels, guiding traders in determining the optimal entry and exit points for their trades. The inclusion of supply-demand min and max levels enhances trading precision by providing clear benchmarks for assessing zone strength.

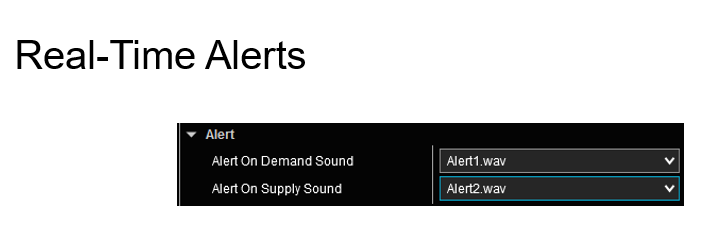

Real-Time Alerts: The software delivers real-time alerts that notify traders of significant developments in supply and demand dynamics, ensuring that they stay informed and responsive to market changes. These alerts enable traders to capitalize on timely opportunities, adjust their trading strategies based on evolving market conditions, and act decisively in response to critical supply and demand shifts. Real-time alerts contribute to heightened situational awareness and prompt decision-making, enhancing overall trading efficiency.

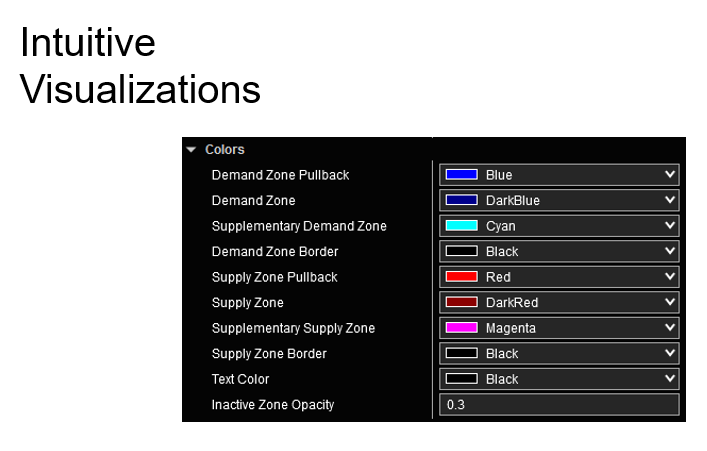

Intuitive Visualizations: Orderflows Algo presents intuitive visualizations that present supply and demand zones, orderflows data, and key market insights in a clear and accessible manner. These visual representations facilitate quick comprehension of complex market information, enabling traders to interpret data effectively and make well-informed decisions. The intuitive visualizations streamline the analysis process, allowing traders to navigate market trends with confidence and agility.

The unique features of Orderflows Algo, including customizable parameters, advanced orderflows analysis, supply-demand min and max, real-time alerts, and intuitive visualizations, collectively elevate trading precision and decision-making. By leveraging these features, traders can gain a deeper understanding of supply and demand dynamics, respond to real-time market shifts, and execute trades with confidence, positioning themselves for success in the dynamic world of trading.

The Orderflows Algo will revolutionize your trading

Identifying Strong Supply Zones: Imagine using Orderflows Algo to identify a strong supply zone after a period of intense buying activity. The software pinpoints the level where substantial selling pressure is likely to emerge, allowing you to strategically position short trades for maximum profitability. With the ability to precisely recognize these supply zones, you gain an edge in timing your entries and profiting from market reversals.

Capitalizing on Fresh Demand Zones: Orderflows Algo alerts you to the emergence of a fresh demand zone following a significant downward move. The software recognizes the entry of new buyers into the market, signaling a potential reversal in price action. Armed with this insight, you confidently position long trades within the demand zone, capturing the upswing in market sentiment and capitalizing on the newfound demand.

These specific trade scenarios demonstrate the undeniable power and strength of the Orderflows Algo software, showcasing its ability to transform trading strategies, enhance decision-making, and drive trading success.

Why choose the Orderflows Algo?

1. Customizable Parameters of Supply and Demand Strength:

- Empowers traders to tailor analysis and strategy development.

- You can fine-tune to align with specific trading styles and preferences.

- Optimizes decision-making based on unique market insights.

2. Advanced Orderflows Analysis:

- Provides deep insights into market order flow and sentiment.

- Identifies buying and selling pressure for informed decisions.

- Anticipates potential reversals through real-time order flow analysis.

3. Supply-Demand Min and Max:

- Offers clear boundaries for identifying and evaluating supply and demand zones.

- Guides traders in determining optimal entry and exit points for trades.

- Enhances trading precision by providing clear benchmarks for assessing zone strength.

4. Real-Time Alerts:

- Notifies traders of significant developments in supply and demand dynamics.

- Ensures traders stay informed and responsive to market changes.

- Enables timely opportunities and prompt decision-making for enhanced trading efficiency.

5. Intuitive Visualizations:

- Presents supply and demand zones, order flow data, and key market insights in a clear manner.

- Facilitates quick comprehension of complex market information for well-informed decisions.

- Streamlines the analysis process, allowing traders to navigate market trends with confidence and agility.

- Empowers traders to tailor analysis and strategy development.

- You can fine-tune to align with specific trading styles and preferences.

- Optimizes decision-making based on unique market insights.

2. Advanced Orderflows Analysis:

- Provides deep insights into market order flow and sentiment.

- Identifies buying and selling pressure for informed decisions.

- Anticipates potential reversals through real-time order flow analysis.

3. Supply-Demand Min and Max:

- Offers clear boundaries for identifying and evaluating supply and demand zones.

- Guides traders in determining optimal entry and exit points for trades.

- Enhances trading precision by providing clear benchmarks for assessing zone strength.

4. Real-Time Alerts:

- Notifies traders of significant developments in supply and demand dynamics.

- Ensures traders stay informed and responsive to market changes.

- Enables timely opportunities and prompt decision-making for enhanced trading efficiency.

5. Intuitive Visualizations:

- Presents supply and demand zones, order flow data, and key market insights in a clear manner.

- Facilitates quick comprehension of complex market information for well-informed decisions.

- Streamlines the analysis process, allowing traders to navigate market trends with confidence and agility.

The Orderflows Algo is designed with user-friendly interfaces and intuitive visual representations to simplify the analysis process, ensuring that even novice traders can use it effectively.

Extensive user guide is available to assist traders in understanding and utilizing the Orderflows Algo to its full potential.

The real-time alerts are meticulously crafted to deliver accurate and timely information, minimizing the reliance on technical expertise and ensuring that traders can act decisively based on reliable data.

The Orderflows Algo stands out as a powerful tool that offers simplicity, accuracy, and potential for consistent profits. By combining customizable parameters, advanced analysis, clear boundaries, real-time alerts, and intuitive visualizations, the software empowers traders to make informed decisions and navigate the dynamic landscape of trading with confidence and agility.

Extensive user guide is available to assist traders in understanding and utilizing the Orderflows Algo to its full potential.

The real-time alerts are meticulously crafted to deliver accurate and timely information, minimizing the reliance on technical expertise and ensuring that traders can act decisively based on reliable data.

The Orderflows Algo stands out as a powerful tool that offers simplicity, accuracy, and potential for consistent profits. By combining customizable parameters, advanced analysis, clear boundaries, real-time alerts, and intuitive visualizations, the software empowers traders to make informed decisions and navigate the dynamic landscape of trading with confidence and agility.

Limited Time Offer: Elevate Your Trading Experience with Orderflows Algo Lifetime License For Just $149!

Ready to supercharge your trading strategies and unlock a new level of precision and profitability? Don't miss out on this limited-time opportunity to gain access to Orderflows Algo, the cutting-edge trading software that empowers you with real-time insights and unparalleled decision-making capabilities.

Choose which way to pay... PayPal or Stripe

To use PayPal:

To use Stripe:

Once your payment has been processed, the Orderflows Algo indicator will be sent to the email address you used to complete your transaction. All emails are usually sent within 3-6 hours. Usually much sooner.

FAQs

Q. How do I access the indicator after purchasing?

A. Once your payment has been processed, the Orderflows Algo indicator will be sent to the email address you used to complete your PayPal transaction. All emails are usually sent within 3-6 hours. Usually much sooner.

A. Once your payment has been processed, the Orderflows Algo indicator will be sent to the email address you used to complete your PayPal transaction. All emails are usually sent within 3-6 hours. Usually much sooner.

Q. What trading platform does the Orderflows Algo run on?

A. Orderflows Algo runs on the desktop version of NinjaTrader 8, both the free and paid version.

A. Orderflows Algo runs on the desktop version of NinjaTrader 8, both the free and paid version.

Q. Is there an MT4/5 or Sierra Chart version of this indicator?

A. No, currently the Orderflows Algo is only available for NinjaTrader 8.

A. No, currently the Orderflows Algo is only available for NinjaTrader 8.

Q. I am a short term trader, I look at the DOM and tick charts. Will Orderflows Algo help me?

A. Yes. Orderflows Algo analyzes volume traded on the bid and volume on the offer. I prefer to run Orderflows Algo on charts ranging from 30-seconds to 1-minute to 15-minutes and range charts between 4 range and 10 range as well as tick and volume based charts.

A. Yes. Orderflows Algo analyzes volume traded on the bid and volume on the offer. I prefer to run Orderflows Algo on charts ranging from 30-seconds to 1-minute to 15-minutes and range charts between 4 range and 10 range as well as tick and volume based charts.

Q. What timeframes does the indicator work on?

A. Order flow is best utilized on short time frames. Orderflows Algo is best utilized on charts ranging from 30-seconds to 1-minute to 15-minutes and range charts between 4 range and 10 range as well as tick and volume based charts.

A. Order flow is best utilized on short time frames. Orderflows Algo is best utilized on charts ranging from 30-seconds to 1-minute to 15-minutes and range charts between 4 range and 10 range as well as tick and volume based charts.

Q. Is Orderflows Algo a footprint chart and does one come with it?

A. No, the Orderflows Algo analyzes the data from the order flow so you do not need a footprint chart or a market depth chart.

A. No, the Orderflows Algo analyzes the data from the order flow so you do not need a footprint chart or a market depth chart.

Q. Do I need the Orderflows Trader software to run Orderflows Algo?

A. No. Orderflows Algo is a stand-alone indicator that interprets the order flow liquidity and price action in the market.

A. No. Orderflows Algo is a stand-alone indicator that interprets the order flow liquidity and price action in the market.

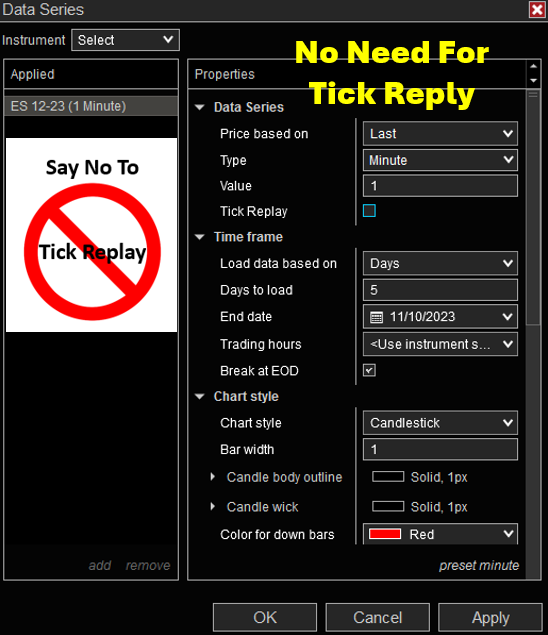

Q. Do I need tick replay to run Orderflows Algo?

A. No, tick replay is not required to run the Orderflows Algo.

A. No, tick replay is not required to run the Orderflows Algo.

Q. Do I need Level 2 data to run Orderflows Algo?

A. No, Orderflows Algo will run on normal Level 1 data.

A. No, Orderflows Algo will run on normal Level 1 data.

Q. Do I need to use a footprint chart to use Orderflows Algo?

A. No. Orderflows Algo will run on any chart type. It will run on regular bar charts, candlesticks charts. Just about any chart you use, it can be run on.

A. No. Orderflows Algo will run on any chart type. It will run on regular bar charts, candlesticks charts. Just about any chart you use, it can be run on.

Q. How many PCs can I run Orderflows Algo on?

A. One PC per license. To run on additional PCs would require additional licenses.

A. One PC per license. To run on additional PCs would require additional licenses.

Q. Do you offer a free trial?

A. Unfortunately no.

A. Unfortunately no.

Copyright 2023 - Orderflows.com - All rights reserved

Disclaimer and Risk Disclosure:

CFTC Rules 4.41:

Hypothetical or Simulated performance results have certain limitations, unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.

Disclaimer:

This presentation is for educational and informational purposes only and should not be considered a solicitation to buy or sell a futures contract or make any other type of investment decision. Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

CFTC Rules 4.41:

Hypothetical or Simulated performance results have certain limitations, unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.

Disclaimer:

This presentation is for educational and informational purposes only and should not be considered a solicitation to buy or sell a futures contract or make any other type of investment decision. Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

Thanks for subscribing. Share your unique referral link to get points to win prizes..

Loading..